Mortgage Calculator

Modify the values and click the Calculate button to use

Annual Tax & Cost

Annual Tax & Cost Increase

Extra Payments

+ Additional One-Time Payments

Save & Compare Scenarios

Saved Scenarios

Loading...

Total Monthly Payment: $0.00

| Monthly | Total | |

|---|---|---|

| Mortgage Payment (P&I) | $0.00 | $0.00 |

| Extra Payment | $0.00 | $0.00 |

| Property Tax | $0.00 | $0.00 |

| Home Insurance | $0.00 | $0.00 |

| PMI | $0.00 | $0.00 |

| HOA | $0.00 | $0.00 |

| Other Costs | $0.00 | $0.00 |

| Total Out-of-Pocket | $0.00 | $0.00 |

House Price: $0.00

Loan Amount: $0.00

Down Payment: $0.00

Total Out-of-Pocket Cost: $0.00

Total Interest: $0.00

Total Extra Payments: $0.00

Mortgage Payoff Date: N/A

If Payback Biweekly without Extra Payments

Biweekly Payment: $0.00

Payoff Length: 0 years, 0 months

Total Interest: $0.00

Interest to be Saved

With Biweekly Payment Only $0.00

Latest Weekly Average Rates (Source: FRED)

30-Year Fixed: Loading...% 15-Year Fixed: Loading...%

Amortization Schedule

| No. | Mo /Year | Interest $ | Principal $ | Ending Balance $ |

|---|

Table of Contents

Key Takeaways: Understanding Your True Mortgage Costs

- Mortgage payments are more than just principal and interest.

- Your true monthly cost (often called “PITI”) includes Principal, Interest, Taxes (Property), and Insurance (Homeowner’s), plus other potential costs like PMI and HOA fees.

- Understanding the standard formula for your core payment (P&I) is essential, but adding all extra costs is what gives you an accurate budget and prevents surprise escrow bills.

- An advanced mortgage calculator (like the one at

mortgage-calculator.my) allows you to compare scenarios, plan for early payoff, and see the full financial picture. - Making extra payments or switching to a bi-weekly plan can save you significantly on interest and shorten your loan term.

- To get an accurate estimate, always start with realistic values for your home price, interest rate, property tax percentage, and insurance estimates.

What Is a Mortgage and Why Is a Calculator Essential?

A mortgage is a long-term loan used to purchase a property. Most mortgages in the U.S. are fixed-rate, 15 or 30-year loans. Each monthly payment you make is split into two main parts: interest (the cost of borrowing the money) and principal (the portion that pays down your loan balance).

A mortgage calculator is an essential financial planning tool. It helps you by:

- Showing Your True Payment: It breaks down your total monthly cost, so you see the full picture, not just what the bank quotes for principal and interest.

- Comparing Options: It lets you test different loan amounts, interest rates, and terms (like 15 vs. 30 years) to see what fits your budget.

- Budgeting Accurately: It provides exact numbers for your payment and total costs, removing the guesswork from one of the largest financial commitments you’ll make.

Essentially, a calculator is a free tool to help you plan your home loan wisely and confidently.

Understanding PITI+: The Importance of a Complete Cost Breakdown

Buying a home is a major financial step, and knowing exactly what you’ll pay each month is crucial.

Many basic calculators only give you a number for Principal & Interest (P&I). The problem? That number isn’t your final bill. It ignores mandatory costs like property taxes and homeowner’s insurance, which can easily add 20-30% or more to your monthly payment.

This is where the concept of “PITI+” comes in. It’s a comprehensive approach to calculating your total monthly housing expense:

Principal + Interest + Taxes (Property) + Insurance (Homeowner’s) + Plus (Other costs like PMI, HOA fees, etc.).

A good mortgage calculator (for example, the tool at mortgage-calculator.my) is built to handle all these variables. Instead of showing you a single P&I number and leaving you to guess the rest, it provides a clear, big-picture view of your total out-of-pocket cost.

Features to Look For in a Good Calculator

A powerful tool doesn’t just stop at PITI+. For effective planning, look for tools that include:

- Scenario Saving & Comparison: The ability to try different scenarios (e.g., 10% down vs. 20% down, 15-year vs. 30-year loan) and compare them side-by-side.

- Bi-Weekly Payments: A feature to see how splitting your monthly payment and paying every two weeks can accelerate your payoff.

- Interactive Charts: Visuals that break down your monthly costs and an amortization graph that tracks how your principal balance falls over time.

- Report Exports: The option to download a detailed report (like a full amortization schedule) to Excel or PDF for your records.

These features turn a simple calculator into a true financial planning co-pilot.

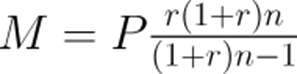

The Formula: How Your Principal & Interest (P&I) Payment is Calculated

The core of any mortgage is the amortization formula. This is the math banks use to determine your fixed monthly Principal and Interest (P&I) payment.

The formula is:

$$M = P \frac{r(1+r)^n}{(1+r)^n – 1}$$

Where:

- M = Your monthly P&I payment.

- P = The principal loan amount (the amount you are borrowing).

- r = Your monthly interest rate (e.g., a 6% annual rate ÷ 12 months = 0.005).

- n = The total number of payments (e.g., a 30-year loan × 12 months = 360 payments).

This formula precisely spreads your payments over the life of the loan. Thankfully, you don’t need to do this math by hand. A calculator instantly computes this for you.

But remember: M is only the P&I. It’s just one piece of your total monthly payment.

What Is the True Monthly Cost? (PITI+ Explained)

As we’ve covered, P&I is just the start. In the real world, homeowners also pay taxes, insurance, and other fees. These are often collected by your lender in an “escrow account” or you must pay them separately.

Your True Monthly Payment (PITI+) is calculated as:

Total Monthly Payment = (P&I) + Taxes + Insurance + PMI + HOA + Other Costs

- P – Principal: The part of your payment that reduces your loan balance.

- I – Interest: The bank’s charge for lending you the money.

- T – Taxes: Your annual property taxes, paid to the local government (divided by 12).

- I – Insurance: Your annual homeowner’s insurance premium (divided by 12).

- + – Plus (Other Recurring Costs):

- PMI (Private Mortgage Insurance): Often required if your down payment is less than 20%.

- HOA (Homeowners Association) Fees: Monthly dues if you live in a condo or a planned community.

For example, your P&I might be $2,000, but your property taxes are $300/month, insurance is $100/month, and PMI is $50/month. Your true total monthly payment is $2,450.

The PITI+ advantage prevents financial surprises. If you only budgeted for the $2,000, you’d be short $450 every single month.

What Inputs You Need for an Accurate Calculation

To get the most accurate estimate from any calculator, you’ll need to gather this information:

- Home Price & Down Payment: The sale price of the home and the amount you plan to pay upfront. The calculator will determine your loan amount and flag if PMI is needed (for <20% down).

- Loan Term & Interest Rate: Your loan term in years (e.g., 15, 30) and the annual interest rate (APR) you expect to get.

- Start Date: The month and year you’ll make your first payment.

- Property Tax: This is crucial. Enter the estimated annual property tax. You can find this by checking local government tax assessor sites for your area (enter as a % of home value or a flat dollar amount).

- Home Insurance & HOA: Enter the estimated annual homeowner’s insurance premium and any monthly HOA fees.

- PMI (Mortgage Insurance): If your down payment is under 20%, enter your estimated PMI cost (often 0.5%–1% of the loan amount per year).

- (Optional) Annual Increases: Some tools let you model inflation (e.g., 2%) for taxes and insurance to see how costs may rise.

- (Optional) Extra Payments: Add any extra monthly, yearly, or one-time payments you plan to make.

The more complete your inputs, the more useful the results.

How to Read and Interpret Your Results

Once you click “Calculate,” review each part of the output:

- Monthly Payment Summary: This clearly shows your P&I payment versus your total monthly payment (PITI+). A good tool will include a pie chart breaking this down.

- Total Costs: Shows the sum of all payments over the life of the loan (P&I) and the total out-of-pocket cost (including taxes/insurance).

- Amortization Table: This is the most detailed part. It breaks down every single payment by date, showing how much goes to interest vs. principal, and your remaining loan balance.

- Payoff Summary (with Extra Payments): If you added extra payments, this section shows your new, earlier payoff date and the total interest you saved.

If a number seems off, double-check your inputs.

Saving Money with Extra Payments

One of the best ways to pay off your mortgage faster and save thousands in interest is by making extra payments toward your principal.

Most calculators let you model this:

- Monthly Extras: Add a fixed extra amount (e.g., $200) to each monthly payment.

- Yearly Extras: Make one extra payment per year (e.g., from a tax refund or bonus).

- One-Time Lump Sum: Add a single large extra payment at any point.

After entering extras, the Payoff Summary will update to show you exactly how many years you’ve cut off your loan and the total interest saved.

Benefits of Extra Payments

- Lower Interest Costs: Extra payments reduce your principal balance, meaning you pay far less interest over the life of the loan.

- Shorter Loan Term: You become debt-free years earlier.

- Build Equity Faster: You build ownership (equity) in your home more quickly.

Considerations for Paying Early

Paying extra has trade-offs. Always consider:

- Prepayment Penalties: Some (rare) loans charge fees for paying off early. Check your mortgage terms.

- Opportunity Cost: Could you earn a higher return by investing that extra money elsewhere (e.g., stocks, retirement funds)?

- Liquidity: Money paid into your mortgage is “locked” in your home and harder to access than cash in a savings account.

Considering Bi-Weekly Payments

Another popular payoff strategy is making bi-weekly payments.

Here’s how it works: Instead of 12 monthly payments, you pay half of your monthly payment every two weeks. Because there are 52 weeks in a year, you’ll make 26 half-payments. This adds up to 13 full monthly payments per year instead of 12.

That “13th payment” goes directly to your principal, dramatically accelerating your payoff.

A calculator with this feature will show you:

- Your new payoff date (often 4-6 years sooner on a 30-year loan).

- Your total interest saved.

Frequently Asked Questions (FAQ)

How do I calculate my monthly mortgage payment?

The easiest way is to use a PITI+ calculator. To do it manually, first use the amortization formula (listed above) to find your Principal & Interest (P&I). Then, add your monthly property tax (annual tax ÷ 12), monthly homeowner’s insurance (annual premium ÷ 12), and any monthly PMI or HOA fees.

What costs are included in a mortgage payment?

Your total “mortgage payment” (often held in escrow) can include:

- Principal & Interest: The main loan payment.

- Property Taxes: Monthly share of your annual property tax bill.

- Homeowner’s Insurance: Monthly share of your insurance premium.

- PMI: If your down payment was under 20%.

- HOA Fees: Any monthly dues to a homeowners association.

How do extra payments affect my mortgage?

Extra payments go directly to the principal balance. This reduces the amount of interest you owe over the long term and helps you pay off the entire loan faster.

Are there downsides to paying off a mortgage early?

Potential downsides include:

- Prepayment Penalties (rare, but check your contract).

- Loss of Liquidity (cash is tied up in home equity).

- Opportunity Cost (you might get higher returns investing elsewhere).

- Smaller Tax Deduction (you pay less interest, so you have less mortgage interest to deduct, if you itemize).

How much house can I afford?

This depends on your income, debts, and down payment. A common guideline is the 28/36 rule: your total housing costs (PITI+) should be under 28% of your gross monthly income, and your total debt (including housing, car, credit cards) should be under 36%. Use a calculator to work backward: enter different home prices until the total monthly payment fits comfortably within that 28% threshold.

Conclusion

Understanding the true cost of homeownership is the first step to making a smart financial decision. Don’t get fixated on the P&I payment alone. By using a comprehensive PITI+ mortgage calculator, you’ll see the full picture, including taxes, insurance, and other fees.

Modeling different scenarios, exploring extra payments, and understanding your amortization schedule will give you control over your finances.

Ready to take control? Try plugging your numbers into our free mortgage calculator at mortgage-calculator.my. It’s designed to give you clarity and help you budget with confidence.

Disclaimer

This mortgage calculator is a free online tool provided for informational and educational purposes only. The calculations and results are based on the data you provide and are intended to be estimates.

The information presented here does not constitute financial, investment, or legal advice. You are solely responsible for any decisions or actions you take based on the information from this tool. We strongly recommend that you consult with a qualified professional, such as a financial advisor or mortgage broker, before making any financial commitments.

About the author: https://mortgage-calculator.my/author/mortgage-calculator/

About Us: https://mortgage-calculator.my/about/